Why Turkey?

ROBUST ECONOMY

- The Turkish economy posted record growth and climbed from 18th place to 13th globally from 2003 to 2019 in the Economies by GDP at PPP.

- Turkey has outpaced its peer economies, and the growth momentum is set to continue in the coming years in average annual GDP Growth 2003-2020

- Over the past 18 years, Turkey has put in a noteworthy performance by increasing the size of its overall economy from USD 236 billion in 2002 to USD 717 billion in 2020

- With an eye-catching 11 percent average annual growth in exports, Turkey has outpaced the world performance and increased its export volume from USD 36 billion to USD 171 billion over the past 17 years.

- In line with its remarkable performance, Turkey’s share in global exports has increased from less than 0.6 percent in 2002 to close to 0.92 percent in 2019.

LARGE DOMESTIC AND REGIONAL MARKETS

- Turkey’s performance in economic development saw its income per capita increase from USD 3,581 in 2002 to USD 9,632 in 2018.

- Turkey is the 11th largest economy in terms of GDP per capita among countries with population over 50 million.

- More than 23 urban centers, each with populations of over 1 million, support Turkey’s thriving domestic market through their production of goods and services. In terms of population, Istanbul is the largest city in Europe.

- 72 million broadband internet subscribers in 2018, up from 0.1 million in 2002 (ICTA, TurkStat)

- 80.6 million mobile phone subscribers in 2018, up from 23 million in 2002 (TurkStat)

- 66.3 million credit card users in 2018, up from 16 million in 2002 (Interbank Card Center)

- 211 million airline passengers in 2018, up from 33 million in 2002 (General Directorate of State Airports Authority)

- 45.6 million international tourist arrivals in 2018, up from 13 million in 2002 (TurkStat)

STRATEGIC LOCATION

- Turkey is a natural bridge between both the East-West and the North-South axes, thus creating an efficient and cost-effective hub to major markets.

- Turkey offers easy access to 1.5 billion people and a combined market worth of USD 24 trillion GDP in Europe, MENA, and Central Asia within a 4-hour flight radius.

- Turkey’s strategic location enables easy reach to markets across 16 different time zones, from Tokyo to New York.

- Turkish Airlines connects 255 destinations in 122 countries.

- Multinationals are increasingly choosing Turkey as a preferred hub for manufacturing, exports, as well as management (Toyota, Ford, Nestle, Hugo Boss, etc)

- Turkey also serves as a management hub for several multinational companies. (B/S/H, Knauf, Intel, Powerchina, Verifone, GSK, etc)

FAVORABLE DEMOGRAPHICS

-

The young and well-educated population of Turkey is a great asset as investors are facing considerable challenges elsewhere in Europe with ageing and shrinking populations.

-

Turkey offers excellent opportunities with its growing, young, and dynamic population – the driving force behind a strong labor pool and a lucrative domestic market.

-

Turkey’s population was registered as 82 million in 2018. It is expected to reach 86.9 million by 2023, and 100.3 million by 2040, according to the Turkish Statistical Institute (TurkStat). The population is projected to maintain its growth momentum until 2069, when it will peak at 107.6 million.

-

Turkey, with half of its population under the age of 32 in 2018, has the largest youth population among the EU member countries.

SKILLED AND COST-COMPETITIVE LABOR FORCE

-

Turkey’s overall labor force is around 32.7 million people, which makes the country the 3rd largest labor force in Europe.

-

Turkey’s young population is an important contributor to labor force growth and has boosted the country’s rank over peer countries. Turkey has posted the largest labor force growth among the EU countries.

-

A rapid expansion in the number of universities has allowed Turkey to have more university graduates, enabling Turkey to transform its young population and large labor force into a skilled workforce.

-

More than 6.7 million students are enrolled in higher education currently

-

Over 800,000 university graduates annually

-

World-class engineering education

LIBERAL INVESTMENT CLIMATE

-

Turkey’s investment legislation is simple and complies with international standards while offering equal treatment for all investors.

-

The fundamental parts of the overall investment legislation include the Encouragement of Investments and Employment Law No. 5084, Foreign Direct Investment Law No. 4875, the Regulation on the Implementation of the Foreign Direct Investment Law, multilateral and bilateral investment treaties, and various laws and related sub-regulations on the promotion of sectorial investments.

FOREIGN DIRECT INVESTMENT LAW

-

The aim of the Foreign Direct Investment (FDI) Law No. 4875 is as follows:

-

to encourage FDI in the country

-

to protect the rights of investors

-

to align the definitions of an investor and investment with international standards

-

to establish a notification-based system rather than an approval-based one for FDI

-

to increase the volume of FDI through streamlined policies and procedures

-

-

The FDI Law provides a definition of foreign investors and foreign direct investments. In addition, it explains important principles of FDI, such as freedom to invest, national treatment, expropriation and nationalization, freedom of transfer, national and international arbitration and alternative dispute settlement methods, valuation of non-cash capital, employment of foreign personnel, and liaison offices.

-

The Regulation on the Implementation of the FDI Law consists of specifying the procedures and principles set forth in the FDI Law. The aim of the FDI Law with regard to the work permits for foreigners is:

-

to regulate the work carried out by foreigners

-

to stipulate the provisions and rules on work permits given to foreigners

-

BILATERAL AGREEMENTS FOR THE PROMOTION AND PROTECTION OF INVESTMENT

- Bilateral Agreements for the Promotion and Protection of Investments have been signed from 1962 onwards with countries that show the potential to improve bilateral investment relations. The basic aim of bilateral investment agreements is to establish a favorable environment for economic cooperation between the contracting parties by defining standards of treatment for investors and their investments within the boundaries of the countries concerned. The aim of these agreements is to increase the flow of capital between the contracting parties, while ensuring a stable investment environment. In addition, by having provisions on international arbitration, they aim to prescribe ways to successfully settle disputes that might occur among investors and the host state. Turkey has signed Bilateral Investment Treaties with 98 countries; however, Turkey is a dualist country, where an international treaty has to be ratified and promulgated in order to become part of the national legal system. Within this regard, 81 Bilateral Investment Treaties out of these 98 have gone into effect so far.

DOUBLE TAXATION PREVENTION TREATIES

-

Turkey has signed Double Taxation Prevention Treaties with 85 countries. This enables tax paid in one of two countries to be offset against tax payable in the other, thus preventing double taxation.

-

Turkey is continuing to expand the area covered by the Double Taxation Prevention Treaty by adding more countries on an ongoing basis.

SOCIAL SECURITY AGREEMENTS

-

Turkey has signed Social Security Agreements with 30 countries. These agreements make it easier for expatriates to move between countries. The number of these countries will increase in line with the increased sources of FDI.

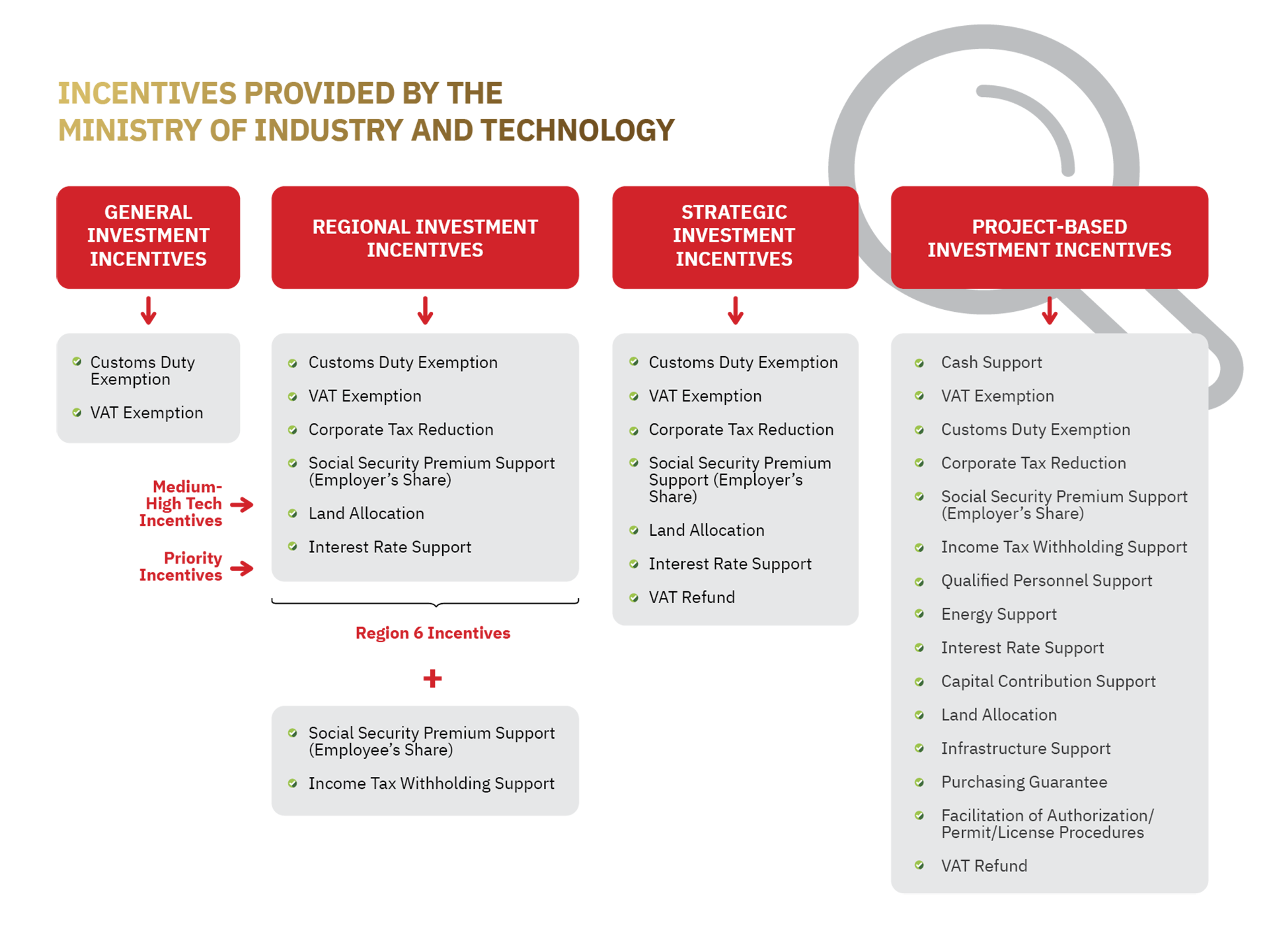

LUCRATIVE INCENTIVES

- Applicable both for greenfield and brownfield projects, Turkey offers a comprehensive investment incentives program with a wide range of instruments that helps to minimize the upfront cost burden and accelerate the returns on investments.

- These incentives may also be tailored for projects in priority sectors classified as key areas for the transfer of technology and economic development. In addition, the Turkish government provides generous support programs for R&D and innovation projects, employee training initiatives, and for exporters through various grants, incentives, and loans.

INVESTMENT INCENTIVES

-

- VAT Exemption : Value-Added Taxes is not payable for machinary and equipment to be purchased.

- Custom Duty Exemption : Custom Duty Exemption is not payable for machinary and equipment to be purchased.

- Corporate Tax Reduction : Corporate tax is reducted (total invesment amount *reduction ratio)

- Social Security Premium Support : The employer’s share of Social security Premium calculated for the employer will be covered by the government.

- Income Tax Witholding Support : The income tax determined fort he employer will be exempt

- Interest Rate Support : Meaningfull part of the interest will be covered by the government.

- Land Allocation : Land is allocated for investment based on the availability, in accordance with the principles and procedures set by the Ministry of Environment and Urbanization.

- VAT Refund : VAT Refund is provided for building and construction expenditures.

“R&D AND DESIGN CENTER”AND “TECHNOLOGY DEVELOPMENT ZONES” INCENTIVES

-

- Custom Duty Exemption : Custom Duty Exemption is not payable for machinary and equipment to be purchased from the abroad related with R&D projects.

- Social Security Premium Support (Employer’s share)

- Income Tax Witholding Support : Income tax fort he R&D employer will be exempt.

- R&D Design Discount: R&D and Design expenditures are wholly deductable from the corporate tax base.

- Stamp Duty : No stamp duty is payable for documents

FREE ZONES EXEMPTIONS

-

- VAT Exemption : Value-Added Taxes is not payable for machinary and equipment to be purchased

- Custom Duty Exemption : Custom Duty Exemption is not payable for machinary and equipment to be purchased.

- Corporate Tax Exemption : No corporate tax is exempted.

- Income Tax Witholding Support : The income tax determined fort he employer will be exempt

- Property Tax Exemption : No property tax is payable at free zones.

- Credit Support: Credit oppurtunities with reduced rates are provided to investor to improve exportation.

ADVANTAGEOUS R&D ECOSYSTEM

-

- The Turkish government has set the target of increasing the share of R&D investments within the overall public budget to 2%. As of 2018, this figure has already increased above 1 percent – with the expectation to reach 2 percent over the next several years.

- Extensive R&D incentives in Turkey are further supported by well-educated and highly qualified labor force, competitive cost advantages, and several global companies that are active in the market. All together these form a dynamic ecosystem in Turkey.

İletişim

Türkiye

Muratreis Mah. Selamet Sk. No:9 Üsküdar / İSTANBUL

Telefon +90 216 706 12 90

GSM +90 532 575 00 49

İngiltere

24 Alcester Road, Sale M33 3QP Manchester United Kingdom